Navigating the art world can be daunting. Prices aren’t always transparent, authenticity can be difficult to confirm, and opportunities often circulate in exclusive circles. For both seasoned collectors and first-time buyers, one question often arises: how do I make the right choices with confidence? This is where an art advisory steps in, as trusted guides who can help collectors uncover opportunities, avoid risks, and build meaningful collections that align with both personal passion and financial goals.

To make the most of this partnership, it’s essential to enter the collector–advisor relationship with clarity. The best way to do this is by asking thoughtful questions that reveal not only an advisory’s expertise but also how well they align with your goals and values. To help guide these conversations, here is a checklist of key areas to explore, covering everything from market insights and acquisitions to due diligence, pricing, and long-term strategy.

The art market is global, nuanced, and often opaque. You’ll want to know how they stay on top of trends, what sources they use for comparative pricing, and how they identify opportunities that align with your interests. A strong advisor should be able to provide data-driven perspectives alongside curatorial insight, helping you make choices that balance passion with strategy.

Sourcing works that reflect your taste and goals is at the heart of an advisory’s role. Ask how they approach acquisitions: do they have access to off-market opportunities? How do they handle discretion when privacy matters? An advisory should not only introduce you to works available in galleries or auctions but also open doors to pieces that rarely appear in the public market.

The question of authenticity and provenance is critical in today’s art world. Collectors should ask how their advisory verifies ownership history, coordinates with experts, and safeguards against legal disputes. The right advisory will put rigorous due diligence at the center of every acquisition, giving you peace of mind that your investment is secure.

Unlike real estate or other markets, art prices are often negotiable, but only with the right knowledge. Ask your advisory how they assess value, what benchmarks they use, and how they negotiate on behalf of their clients. The best advisors can save collectors significant sums while ensuring that acquisitions are fairly priced and aligned with long-term value.

Building a collection is one step; preserving it is another. A key question for your advisory is how they support collection management. Do they help organize documentation, invoices, and certificates? Can they recommend storage, conservation, and insurance strategies? This behind-the-scenes work is vital in ensuring that a collection is not only enjoyed but also safeguarded for future generations.

An advisory should help you think beyond immediate acquisitions. Ask how they work with clients to create a long-term roadmap, whether that means planning for future acquisitions, considering loans to institutions, or integrating works into estate and legacy planning. A truly strategic advisor ensures that your collection reflects both your personal passion and your long-term vision.

Selecting an advisory is as much about expertise as it is about chemistry. Alongside these practical questions, consider their experience, transparency in fees, and whether they specialize in areas that align with your goals. Ultimately, trust your instincts. The most successful relationships are built on mutual respect, shared vision, and the confidence that your advisor has only your best interests at heart.

October 28, 2025

“Art washes from the soul the dust of everyday life.” – Pablo Picasso The wonder of experiencing and engaging with art can feel elusive, even exclusionary. Many imagine it as belonging only to the realm of the select few “in the know,” fluent in the language of art. For […]

Buying art is an experience that blends passion, curiosity, and investment. For some collectors, it’s about building a meaningful connection with a work that inspires and resonates. For others, it’s about adding a valuable asset to their portfolio that they may appreciate over time. Whatever your motivation, one fact remains […]

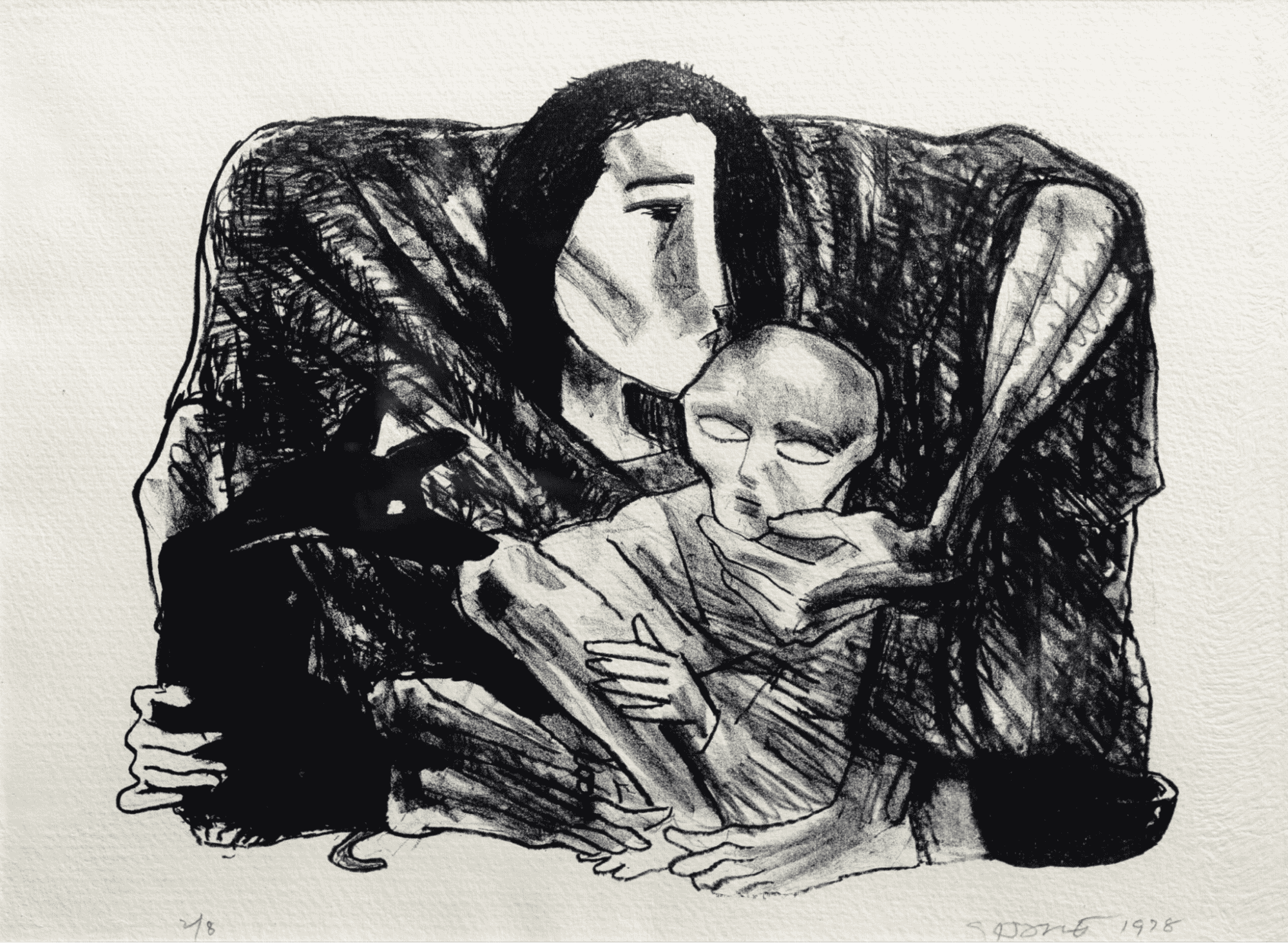

Indian Modern art is a vibrant story of transformation, a journey shaped by colonial encounters, nationalist aspirations, and the search for a distinct visual identity. It reflects the broader story of India itself: negotiating between the local and the global, the inherited and the imagined. Intertwined with history, social change, […]